TigerSoft's Elite Stock

Professional Report

4/18/2008 -

(C) 2008 Wm. Schmidt, Ph.D.

| Abbreviations: price versus 50 day ma: A=Above B=Below AR = Above rising (Bullish) BF = Below Falling H = 12 month high L= 12 month low. Current Accum. Index = IP21 TISI = 21-day ma of IP21 SS = Sell Short BO = Breakout NC = non-confirmation. |

| Buys

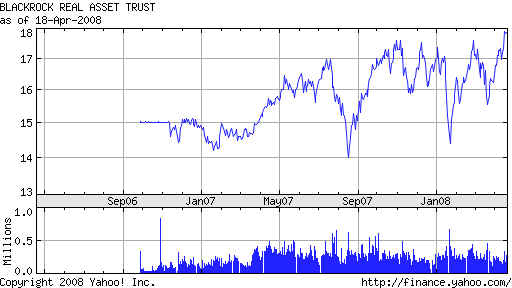

The best below are BCF, SID, IGE, DBC, GSG. Oil stocks are clearly the strongest group. The top Power -Ranked oil stocks are PBR, TOT, MDR, HP, RD, BZP, WFT and APA. As long as oil keeps rising, so will they.. 194 BCF 17.89 +.04 Breakout B24 December bulge of Accumulation. BLACKROCK REAL ASSE (BCF) Earnings up - http://finance.yahoo.com/q/is?s=bcf&annual Historic Breakout |

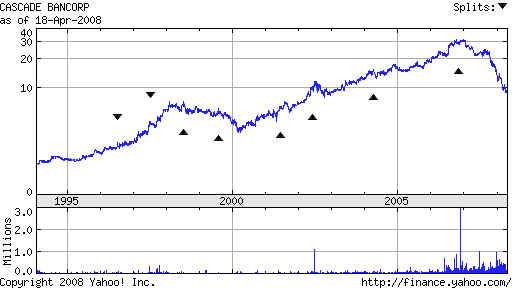

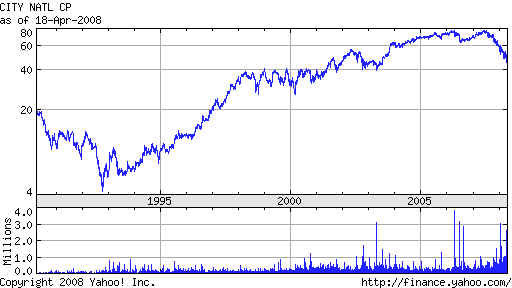

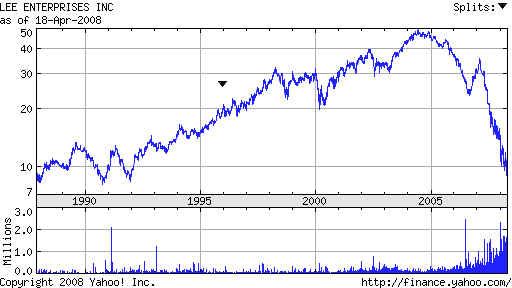

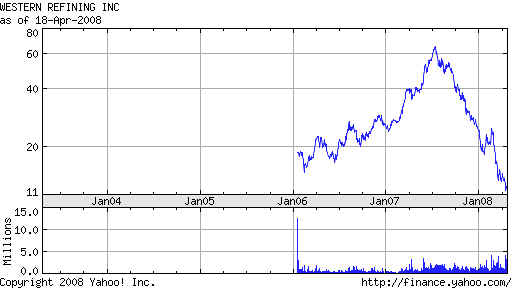

| Short Sales 70 AMIE 5.67 -.02 IP21<-.35  35 CACB 9.23 -.01 IP21=-.30  31 CYN 45.67 -2.20 IP21=-.20  22 LEE 9.14 +.14 IP21=-.22  34 WNR 12.23 +.15 IP21=-.25  |

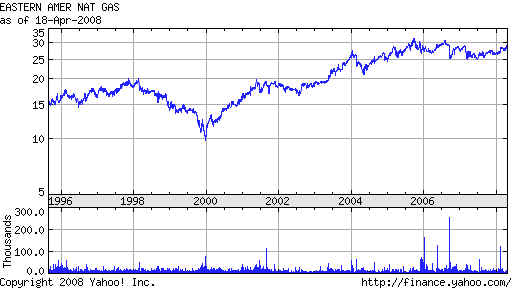

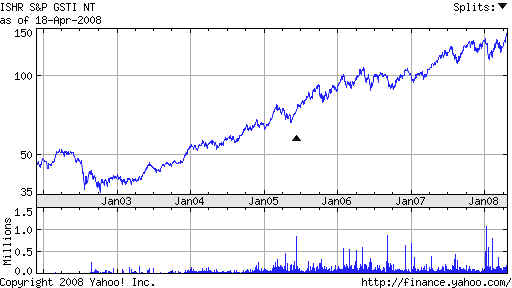

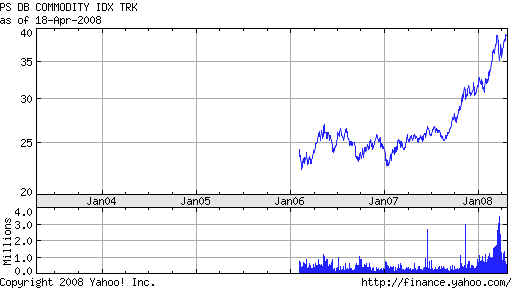

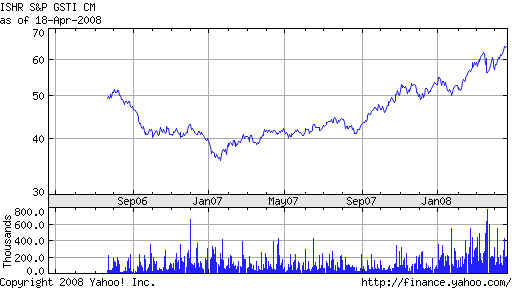

Table 1 - Highest AI/200 Stocks - AR=Stocks must be above rising 50-day ma IP21 must be over .05 AI/200 Stock Notes ====== ================= ==================================================== 200 ADL 3.56 +.06 IP21 recently +.70 H=5.25 L=2.4 196 HIX 9.56 +.02 IP21=.45 Possible turn around. 194 BCF 17.89 +.04 Breakout B24 December bulge of Accumulation. 190 PBR 125.49 Marginal NH. IP21>.25 OBV confirming. False breakout in February. Careful here. 188 BBL 72.19 Very good OBV, H=78 IP21=.40 ITRS=.18 189 CMKG 2.98 +.12 Thin...Very good OBV H=3.20 IP21=.40 Heavy accumulation. First stocks to move are not usually thin special situations. 188 NGT 29.00 _.70 B24. IP21=.50 OBV confirming. ITRS-.01 190 SID 43.4 +.40 NH OBV is OK ITRS=.32 and IP21>.25 188 GENC 27.80 +2.40 Classic explosive super stock. Breakout at 12 in January. 187 UBB 135.55 +2.52 159=H. IP21=.05 186 ARA 76.68 -.16 80.28 =12 mo resistance high. IP21=.10 186 IGE 144.29 +2.59 NH B24 IShares Goldman Natural Resources. Feb bulge of Accum. 184 JLN 8.66 +.21 IP21=.30 H=12 Strong OBV. 184 SVT 18.65 +.05 At rising 50-dma IP21=.05 ITRS=.30. 183 DBC 38.88 +.02 H=39.3 IP21 is tailing off. OBV is strong. ITRS=.16 Recent Accum. Index is a bulge. Commodity ETFs - metals, oil, corn, wheat. 184 XBI 57.01 +.15 at flat 30wk ma resistance. H=62.4 Red Sell. 182 EWT 16.47 -.02 IP21<0 18.2=H Weak OBV. ITRS-.24 181 LRT 2.17 _.01 IP21=.60 neutral OBV. H=2.65 180 IGE 144.29 +2.59 NH B24 OBV NC... Goldman Sachs Natl Resources. ..... 179 DBC 44.09 +.57 OBV NH along with price. IP21=.15 ENERGY ETF 178 MOS 135.25 +1.37 IP21=.13 OBV NH 177 GSG 64.13 +.49 Sept bulge of Accum. Strong OBV NH B24 177 PHIK 37.80 +.43 IP21=.35 OBV NH B24 Thin. |

| Table 2A - New

High Stocks - Stocks must be above 50-day ma. OBV confirm. IP21>.20 To Buy: IP21 should be over .24 or ITRS should be over .30 and AI/200 should be over 140 155 ACI 58.37 +1.93 IP21=.24 NH confirmed by OBV, not ITRS. 172 ANR 51.82 +1.35 IP21=.12 NH confirmed by OBV, not ITRS. 166 APA 142.51 +3.50 IP21=.28 NH confirmed. Running. Breakout was at 122. 161 ATW 111.50 +3.73 IP21=.32 NH confirmed by OBV. 105 was breakout. 120 BBG 54.12 +1.65 IP21=.29 OBV NC 141 BRY 53.40 +1.84 IP21=.27 OBV confirming. 154 BTE 25.10 +.46 IP21=.20 OBV confirming. 143 CLF 163.10 +5.26 IP21=.35 OBV confirming. Breakout was at 130. 141 CPE 20.37 +.39 IP21=.32 OBV confirms NH. Brerakout was at 19.3 152 CXG 41.52 +1.08 IP21=.25 OBV at NH 121 DGLY 9.00 +.40 IP21=.50 OBV is at NH, Breakout at 8. Close to B12. 160 DVN 118.40 +2.26 IP21=.14 OBV is confirming. 158 EAC 47.65 +2.45 IP21=.27 OBV and ITRS confirming. 146 FCL 61.63 +.91 IP21=.12 OBV NC 188 GENC 27.80 +2.40 Classic explosive super stock. Breakout at 12 in January. 176 GESG 64.13 +.49 IP21=.32 OBV confirming. Note earlier bulge of Accum. 164 HCH 183.19 +3.98 149 HOS 49.95 +1.70 IP21=.26 OBV NH 155 HP 56.53 +2.01 IP21=.34 OBV and ITRS confirm. 141 IEZ 71.77 +2.86 IP21=.33 OBV lagging. ITRS NH 186 IGE 144.29 +2.59 NH B24 IShares Goldman Natural Resources. Feb bulge of Accum. B24 after bulge of Accum. 161 INSW 12.22 +.61 IP21=.65 B24 OBV is at NH. 142 NBL 90.55 +2.06 IP21=.30 B24 OBV is at NH 183 NGT 29.00 +.70 H=29 OBV is strong. IP21=.50. ITRS=.03 (low) 177 PHNK 37.80 +.43 NH confirmed. 155 POT 204.67 +10.12 IP21=.30 ITRS>.35 170 SYT 64.08 +.90 IP21=.35 ITRS=.24 166 USO 93.79 +1.42 IP21=.40 ITRS-.30 OBV is confirming. 163 WFT 85.55 +5.51 IP21=.35 ITRS NH OBV confirming. |

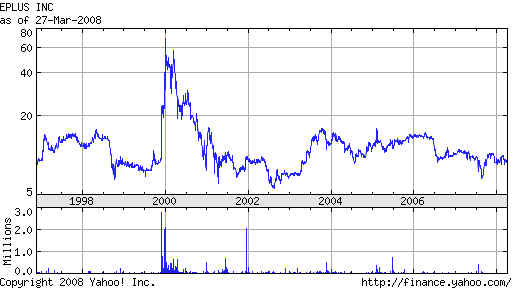

Table 3 - Buy B12 Stocks 177 PLUS 13.30 +.05 B12. Breakout was at 11.25 on Thursday.- 186 GENC 27.80 +2.40 B12. NH ... Breakout was at 12. 147 TTES 59.05 +2.63 Breakout was at 54. |

| Table 4 - New Lows/Bearish Stocks - over $5.00 Weak OBV and negative IP21 and New Lows 9 AGYS 10.21 +.17 Ip21= -.20 AI/200=9 70 AMIE 5.67 -.02 IP21<-.3535 CACB 9.23 -.01 IP21=-.30 52 ICIR 24.13 -3.48 IP21=-.25 6 ISLE 6.99 -.01 IP21=-.06 26 CHS 6.05 +.15 IP21=.15 31 CYN 45.67 -2.20 IP21=-.20 72 DSH 31.40 -.58 IP21=-.30 22 LEE 9.14 +.14 IP21=-.22 26 OMPI 7.00 +.01 IP21=-.38 OBV NC 34 WNR 12.23 +.15 IP21=-.25 |