3/14/2008 -

(C) 2008 Wm. Schmidt, Ph.D.

Abbreviations:

price versus 50 day ma

AR = Above rising (Bullish)

BF = Below Falling

H = 12 month high

L= 12 month low.

Current Accum. Index = IP21

TISI = 21-day ma of IP21

A = above

U = Under (Bearish)

SS = Sell Short

BO = Breakout

----------------------------------------------------------------------------------------------------------

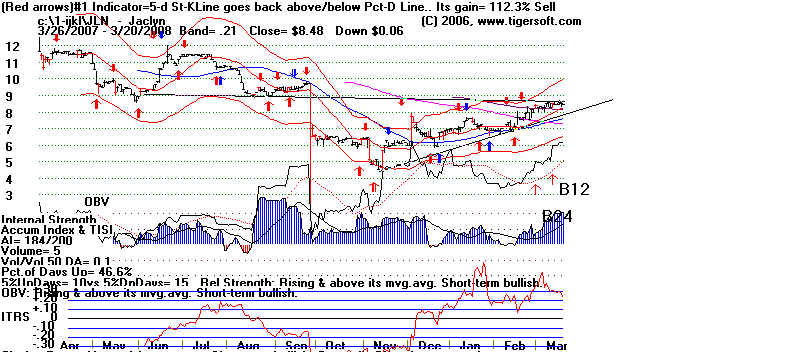

JLN 8.48 184 .53 -1 - Jaclyn

OBV is very strong. But at resistance, point of breakdown.

Probably best to wait for move past 9 to be rsurer that resistance

has been eaten up.

OFG 23.19 +1.33 62 .25 NH confirmed.

Price breakout at 22 above 3 tops. Only a traders' buy.

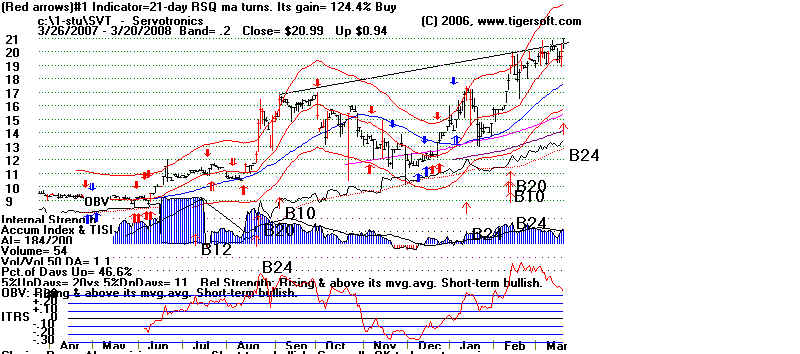

SVT AR

20.99 184 .29 NH 0 Servotronics.

Note earlier Accumulation bulge in June last year.

WMT 53.23 +2.45 80 .15 yes

Traders' breakout above 51.60 4x tested resistance broken on high volume.

ITRS=.18

--------------------- ------- ----- ----------------

ACMR 5.55 -.25 88 -.30 yes

AC Moosre Arts & Crafts

BPL 44.29 -.36 52 -.40 yes

Buckeye Partner ... at bottom of price channel.

BGP 5.07 -2.03 53 -.35 yes

Borders Group

JBL 11.49 -.65 77 -.25 yes

Jabil Circuit

LNET 6.75 -.65 84 -.32 yes

NXJ 12.39 -.10 53 53 -.26 no

Marginal violation of support at 12.5 which

had held 6 times earlier in the last year.

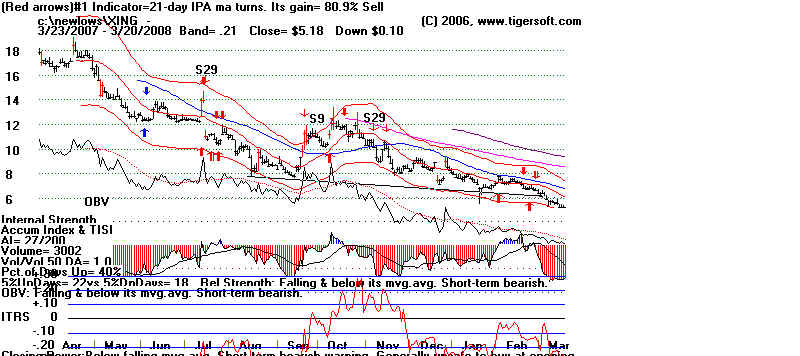

XING 5.18 -.10 27 -.30 yes

Both Opening and Closing Power are falling.

This looks very weak to me.

AI/200>190

AR=above

rising 50-dma

Table 1 Highest AI/200 AI/200>190 AR=above rising 50-dma

Stock Close AI/200 IP21 OBV%-Pr%

--------------------------------------------------------------------------------------------

KTEC 29.03 200 .02 -21

just below rising 200-day ma.

ADL 3.42 200 .67 -8

At diagonal downtrendline.

OPTI 2.45 199 .47 +48

Persistent downtrend-line over-rides high accumulation,

especially for low-priced stocks.

FCM 13.15 198 .09 +7 - Downtrending

CVF 21.1 197 .39 +59

thin and declining

ONVI 6.54 197 .49 0

testing yearly low

BCF 15.54 194 .20 +29 on Sell.

14.5 is uptrendline support.

BBL 55.38 191 .01 +73

sprawling head and shoulders.

PBR 95.84 191 .07 +18

at rising 30-week ma. Note fale breakout at 120.

JLN 8.48 184 .53 -1 - Jaclyn

OBV is very strong. But at resistance, point of breakdown.

SVT AR

20.99 184 .29 NH 0 Servotronics.

Note earlier Accumulation bulge in June last year.

UBB 119.07 +1.79 184 .17 +18 Unibanco

114 = support. Red Buy for traders.

DBC 35.05 183 .42 -9

AR - ETF for metals, oil, corn, wheat - closed above 50-day ma.

RIG 131.04 183 .07 -30

Just below 50-day ma. Weakening OBV.

MDR 49.13 177 .20 -3

sprawling head and shoulders OBV is holding up.

IP21>.15

Stock Close AI/200 IP21 OBV Confirming NH

------------------------------------------- ------- ----- ----------------

CBU 26.06 +1.66 136 .20 0 NH confirmed.

Community Bank System ITRS-.40

DCOM 17.43 +.95 95 .10 0 NH confirmed.

HCBK 18.29 +.59 134 .15 0 slight OBV NC

LNN 96.89 +6.89 117 .24 0 NH NC -

gap and high volume.

NFLX 36.34 +1.37 128 .12 NH confirmed

Previous bulge of Accumulation in February.

Reversal at upper band. IP21 is slipping back.

OFG 23.19 +1.33 62 .25 NH confirmed.

Price breakout at 22 above 3 tops. Traders' buy.

SKIL 10.50 +.86 124 .25 No

Note bulge of Accum. in February.

SVT 20.99 +.94 184 .15 Yes

Note bulge of Accum. last June.

KIL 10.50 +.86 124 .25 No

VLNC 4.50 +.40 118 .25 Yes

Traders' breakout above 4.05 ITRS=.70

WMT 53.23 +2.45 80 .15 yes

Traders' breakout above 51.60 4x tested resistance broken on high volume.

ITRS=.18