TigerSoft's Elite Stock Professional Report 2/15/2008 - (C) 2008 Wm. Schmidt, Ph.D. Abbreviations: price versus 50 day ma AR = Above rising (Bullish) BF = Below Falling Current Accum. Index = IP21 TISI = 21-day ma of IP21 A = above U = Under (Bearish) SS = Sell Short BO = Breakout

-------------------------------------------------------------------------

---- BUYS:----

Symbol Close AI/200 IP21 High/OBV Confirm ITRS

------ ----- ------ ---- ----------- ----

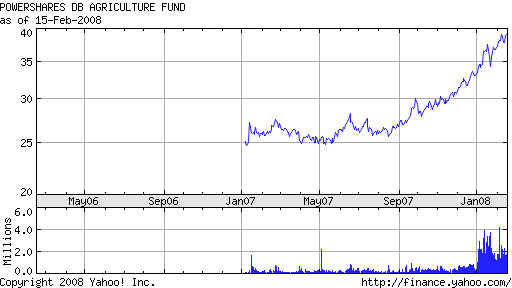

DBA ETF-Corn Wheat Soybeans Sugar 145 .25

39.18 +.18 OBV confirming ITRS=.34

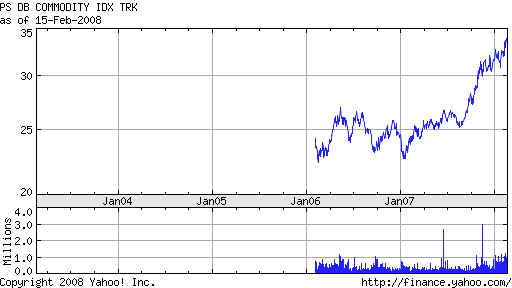

DBC 33.77 -.12 IP21=.30 OBV lagging ITRS=.19

Flat topped breakout

he index commodities are light, sweet crude oil, heating oil,

aluminum, gold, corn and wheat.

DBC 33.77 -.12 IP21=.30 OBV lagging ITRS=.19

Flat topped breakout

he index commodities are light, sweet crude oil, heating oil,

aluminum, gold, corn and wheat.

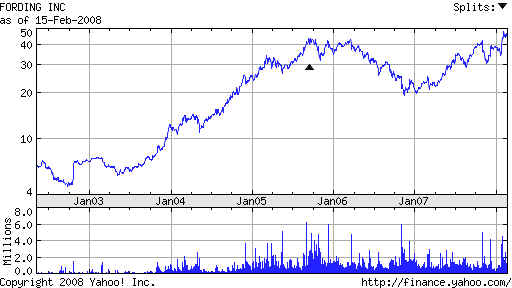

FDG 46.61 +.09 . 161 .50 ITRS=.4o

OBV confirmed last high.

ording Canadian Coal Trust operates as an open-ended mutual fund

in Canada. It owns a 60% interest in Elk Valley Coal Partnership,

which produces and sells hard coking coal, a type of metallurgical coal

used for making steel in the integrated steel mill process.

FDG 46.61 +.09 . 161 .50 ITRS=.4o

OBV confirmed last high.

ording Canadian Coal Trust operates as an open-ended mutual fund

in Canada. It owns a 60% interest in Elk Valley Coal Partnership,

which produces and sells hard coking coal, a type of metallurgical coal

used for making steel in the integrated steel mill process.

KTEC 37.00 -.89 198 .34 ITRS=.18

H=38.8 KTEC Key Techn

KTEC 37.00 -.89 198 .34 ITRS=.18

H=38.8 KTEC Key Techn

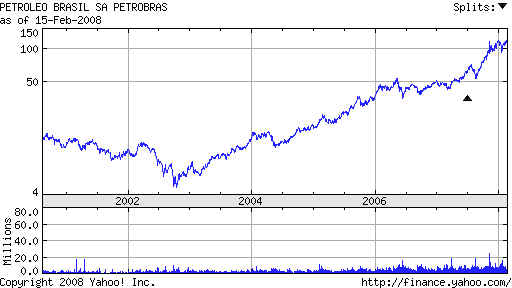

PBR 114.45 -.78 191 .24 ITRS=.26

Petroleo Brasileiro

PBR 114.45 -.78 191 .24 ITRS=.26

Petroleo Brasileiro

---- SHORT SALES: ----

Stock Close AI/200 IP21 OBV Confirming --------------------- ------- ----- ---------------- CYBX 9.74 -.17 60 -.13 yes CyberonicsKERX 5.60 -.19 83 -.20 yes ITRS=-.28

LINE 10.88 -.49 82 -.30 yes ITRS=-.15

PLXT 6.69 -.10 90 -.30 yes Plxt Techn.ITRS--.21

SLE 13.29 -.25 81 -.17 yes Sara Lee ITRS=-.11

SUR 14.78 -.22 75 -.17 yes CNA Aurety Corp. ITRS=-.20

XRIT 8.63 -.07 81 -.50 yes - X-Rite ITRS=-.20

ISSC 8.48 -.16 33 -.20 yes Innovative Solutions & Support

Mostly stocks above their rising 50-day ma are listed here. BF= below falling 50-day ma

Positive Accumulation Consistency for the last year.

200 KEQU 18.02 -.51 itrs=.03

198 KTEC Key Techn 37.00 -.89 ITRS=.18 IP21=.34 H=38.8

195 NBG 11.57 -.05 ITRS=-.07

194 BCF Burlingtom Coat Fact 16.27 +.05 just below flat/decl 200-day ma and 5--day.

193 BBL 61.64 +.33 just above flat/decl 200-day ma

Very Strong OBV,

191 PBR 114.45 -.78 OBV strong...IP21=.20 ITRS=.25

This has flat resistance at a set of 3 tops at 119-120. Above that would be bullish,

186 IGE Natl Resources 125.26 -.69 IP21=.50 OB very strong... H=138.63

184 SVT Servotronics 18.30 -1.36 IP21-.25 OBV is very strong ITRS=.65

181 SVT

16.00 +.30 H=17.10 June bulge of Accumulation. OBV strong.

IP21=.25

178 ISYS

24.75 +.02 H=28 Recent bulge of Accu, Strong OBV ITRS=.14

177 HCH 152.79 -1.99 strong obv 151=12 mo high

170 AZS Ariz Star Res

17.63 -.17

previous bulges of accumulation.

==================================================================================

===================================================================================

======= At New High ========-

Necessary conditions

AI/200>140

IP21 (Current Accum.)>.25

AI/200=>140

confirming OBV

Itrs>.05

There are very few stocks that

meet this conditions.

Bearish = NNC - S9 - IP21 on new Stock

high closing.

IP21 bulge - over 45

Symbol

Close AI/200 IP21

NH High/OBV ITRS

------

----- ------

---- -----------

----------------

CMP Compass Minerals 54.72

130

.30

confirming OBV

.45

DBA ETF Agric Commodities 39.18 145

.25

confirmingOBV

.32

DBC

33.77 -.12 183 .25

OBV NV

.18

DBE ETF Energy

36.33 -.11 161 .40

OBV is very strong

PBT Permian Basin

17.93

137

.20

confirming OBV

.25

PCLN Priceline.com 123.86 +21.69 148

.25

confirming OBV

37 +.95 IP21=.30 OBV lagging ITRS=.12

=======================================================================

Table 4 ======= BUY B12 at 12 mo highs ========

AI/200 should be at least 100.

AZL Arizona Land Income 7.70 +.25

AI/200=109 IP21=.44 OBV confirming ITRS=.45

FDG 46.61 +.09

AI/200=161 IP21=.50 OBV confirmed last high. ITRS=.38

Best - short Only Stocks also with an IP21<-.09 and over $5.

AI/200

With the market down already 8% from its highs and a new red

Buy signal from the NASDAQ, I post only the stocks here that

a considered "bearish" among the stocks that have recently made

a new lows. We would also want to look at high volume new lows,

because these might be special situations.

There is good evidence that the stocks when an AI/200 score less

than 62 are weaker. Tax loss selling is now a bearish factor for

them.

======================= Bearish and New Lows ============================

AI/200 should be below 62 here. Stoch should be below 21-day ma.

Stock Close AI/200 IP21 OBV Confirming

--------------------- ------- ----- ----------------

AHS 14.33 -.15 77 -.20 YES

ARNA 6.87 -.31 59 -.20 no

ARRS 5.50 -2.41 63 -.04 yes

CTAS 29.70 -.22 79 -.05 yes

CYBX 9.74 -.17 60 -.13 yes Cyberonics

KERX 5.60 -.19 83 -.20 yes

LINE 10.88 -.49 82 -.30 yes

PLXT 6.69 -.10 90 -.30 yes Plxt Techn.

SLE 13.29 -.25 81 -.17 yes Sara Lee

SUR 14.78 -.22 75 -.17 yes

WMK 35.05 -.07 54 -.10 no

XRIT 8.63 -.07 81 -.50 yes - X-Rite