TigerSoft's Elite Stock

Professional Report

6/13/2008 -

(C) 2008 Wm. Schmidt, Ph.D.

Look also at a new list, Table 3.

This shows stocks with significant Accumulation Index bulges at some time this past year.

These stocks will show a Buy B24 if they make a new high. Use Buy B6, B7, B8 and

B9s.

Buy on pullbacks to a 50-day and a 50-day ma.

Contents:

Bullish Selections

Bearish Selections

Table 1 - Highest AI/200 Stocks

Table 2 - New High Stocks -

Table 3 - Accumulation Index Bulges

and Buy B12 Stocks

Table 5 - New Lows/Bearish Stocks - over $5.00

| Abbreviations: price versus 50 day ma: A=Above B=Below AR = Above rising (Bullish) BF = Below Falling H = 12 month high L= 12 month low. Current Accum. Index = IP21 TISI = 21-day ma of IP21 SS = Sell Short BO = Breakout NC = non-confirmation. |

| Buys

177 PHX 35.33 +1.45 IP21=.15 OBV NC H=31.80 bulge of Accum in April. http://www.panra.com 18 employees. Panhandle Oil and Gas, Inc. engages in the acquisition, management, and development of oil and gas properties. Its mineral properties and other oil and gas interests are located in the United States, primarily in Arkansas, Kansas, Oklahoma, New Mexico, and Texas

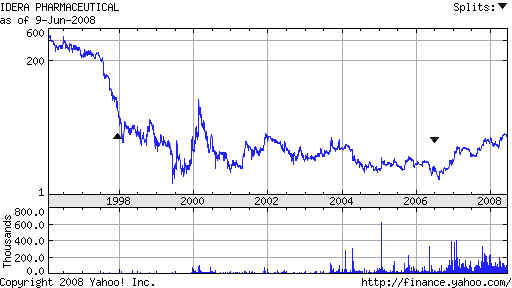

162 IDRA 14.99 +.33

IP21=.40 Support at rising 21-day, Accum. Index bulge in April 163 ICO

11.94 +.95 Up from April breakout at 7. IP21=.25 OBV OK.

Nearing upper band.

|

|

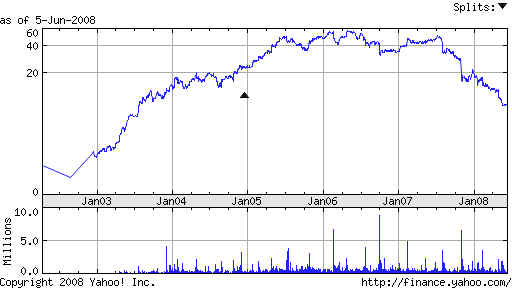

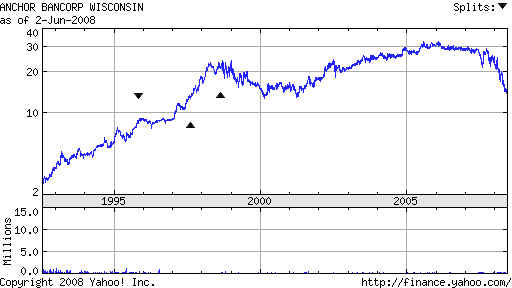

| Short Sales ABCW 11.16 -.52 OBV confirming NL Anchor Bancorp Wisconsin Anchor Bancorp Wisconsin, Inc. operates as the holding company for AnchorBank, fsb that provides various financial services in Wisconsin, Iowa, Minnesota, and Illinois. Its deposit products include passbook savings accounts, demand deposits, checking accounts, money market accounts, and certificates of deposit.  BPFH 6.24 -.33 OBV confirming NL IP21=-.15 Boston Private Financial Holdings, Inc. operates as the multi-bank holding company in the United States. It provides private banking, investment management, and wealth advisory services to high net worth individuals, families, businesses, and select institutions.  CATY 13.11 -.70 OBV confirming NL. high volume on deccline. http://www.cathaybank.com Cathay General Bancorp operates as the holding company for Cathay Bank, which offers various financial services for individuals, professionals, and small to medium-sized businesses primarily in California  CTBK

11.53 -.36 OBV confirms new low IP21= -.10 |

|

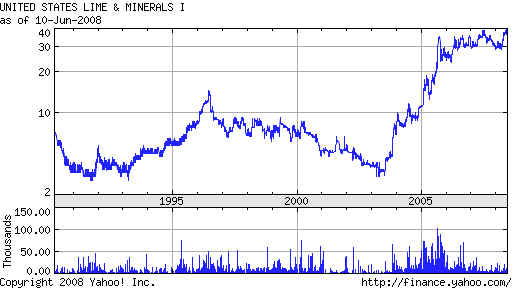

Table 1 - Highest AI/200 and Highest IP21 Stocks AR=Stocks must be above rising 50-day ma OBV should confirm IP21 must be over .05 Changes were for last week, unless otherwise stated. AI/200 Stock Notes ====== ================= ==================================================== 200 PLUS 13.40 +.25 Challenging high at 13.7 IP21=.25 Steady high acdcumulation. 200 CMKG 2.94 Thin...Very good OBV H=3.20 IP21=.60 Heavy accumulation. 200 CVF Castle Convertible 24.26 -.02 Red Sell H=26 IP21>.35 199 BCF 18.04 OBV confirmed recent NH IP21=.0 Red Sell. At minor support. December bulge of Accumulation. 197 SID 45.01 +.05 NH OBV is OK ITRS>.22 and IP21>.10. At rising 50-dma 196 HIX 9,91 IP21=.05 Possible turn around. Now slightly above rising 200-day ma | 195 SYT 60.75 -.90 IP21=.20 H=66 Very Good OBC Red Sell. 195 KTEC 37 -.64 IP21=.25 H=39.25 this week. OBV is lagging. 190 ARA 82.80 -1.19 At 50-dma IP21<0 Aracruz Celulose 188 DAIO 5.86 +.26 H=6.7 IP21=.55 ITRS=.32 Red Sell Support at 21-day ma. 187 HCP 34.36 +.88 Below falling 50-dma H=38.25 OBV NC IP21=-.12 186 NGT 29.84 +1.09 Challenging 30 high. OBV is making NH ahead of price. IP21=.20 186 UBB 137.08 +1.08 OBV is lagging IP21<.1 Red buy 185 ADRE Emerging Mkts ADR 52.37 +.47 IP21<0 H=60.10 head and shoulders top? 184 XBI 57,92 +.85 H=62.4 IP21=.30 Red Sell OBV lagging 182 DBC 43.60 -.28 Running ITRS=.21 OBV is confirming. Recent Accum. Index bulge. Commodity ETFs - metals, oil, corn, wheat. 182 ISYS 37.93 +.58 NH IP21=.30 Last week B12 OBV confirming run. At rising 21-dma Watch out - head and shoulders pattern neckline=35 181 SNT 1.91 +.36 B12 1.9 5 is April peak. 180 AKS 70.68 +2.43 IP21=.20 Up from rising 50-dma. Flat resistance=73.25 ................................................................................................................. 179 TS 62.57 +.02 OBV lagging badly. IP21=.10 179 MOS 153.31 +5.82 NH at upper band. IP21=.10 OBV strong. 175 AXYS 58.77 +1.03 Breakout point held on pullback. IP21=.22 173 PMFG 46,95 +.46 OBV is lagging. Challenging 48 high. IP21=.23

171 GSG 72. -.88 NH IP21<0 Sept &

April bulge of Accum. |

|

| Table 2

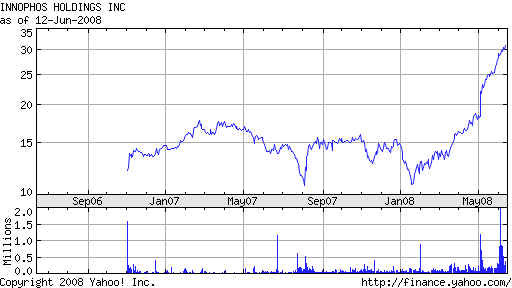

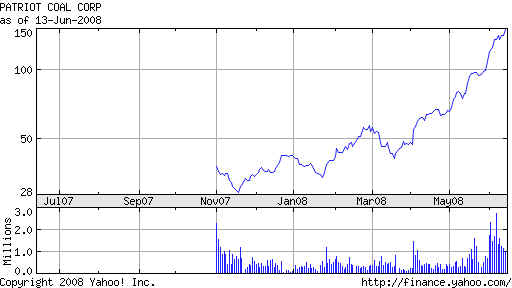

- New High Stocks - Stocks should be above 50-day ma. OBV confirm. IP21>.20 To Buy: IP21 should be over .24 or ITRS should be over .30 and AI/200 should be over 140 Consider a stock with an Accum. Index bulge over .50 to be capable of advancing for 12 months after the bulge. 152 ABMD 18.38 +.38 NH P21=.40 OBV is at NH Abiomed 185 ANR 94.25 +5.61 NH at upper band. OBV is lagging. Up from 55 in April. 169 ACI 72.79 +2.13 IP21=.10 NH confirmed by OBV 154 BTE 32.18 +1.19 IP21=.20 OBV NC 156 BUCY 75.36 +1.57 IP21<0 OBV confirmed high At upper band. 181 BZP 26.19 +0.57 IP21=.10 OBV confirming. High Vol (red) Reversal Day down 106 CPX 32.50 +.86 April bulge of Accum OBV is confirming NH run. 143 HUSA 8.50 +.68 April Bulge of Accum Up from 6,5 Ip21=.18 ITRS is confirming. 163 ICO 11.94 +.95 Up from April breakout at 7. IP21=.25 OBV OK. Nearing upper band. 127 INTX 11.39 +.89 Breakout this week past 11. OBV is confirming. April bulge of Accum. 135 IPHS 32.91 +1.80 Run started at 18 on Apri IP21=.30 OBV confirming. ITRS confirming. 180 JRCC 48.64 +3.29 March run started at 20. IP21=.25 OBV is lagging James River Coal. 164 MEE 81.84 +5.77 IP21=.10 OBV is lagging Red high vol at upper band. Coal 181 MOS 153.31 +5.82 IP21=.10 OBV confirming ... At upper band. 114 PCX 148.69 +8.09 IP21=.25 OBV is confirming. Move started at 60 in April. 152 RBCAA 25.63 +.27 NH IP21=.48 OBV confirms 154 SPW 139.72 +7.90 IP21=.12 OBV is lagging. | 165 SQNM 14.94 +2.10 IP21=.20 OBV is not confirming. Move started at 9 only 2 weeks ago. 129 USPH 18.11 +.51 IP21=.14 OBV is confirming|

|

|

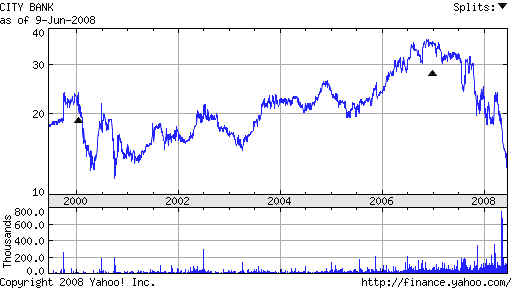

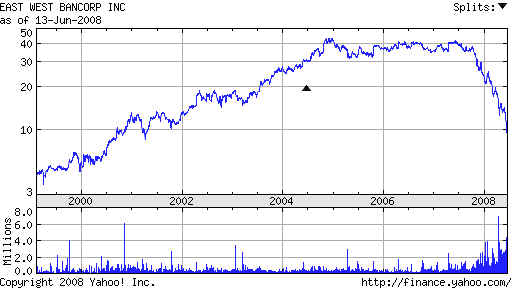

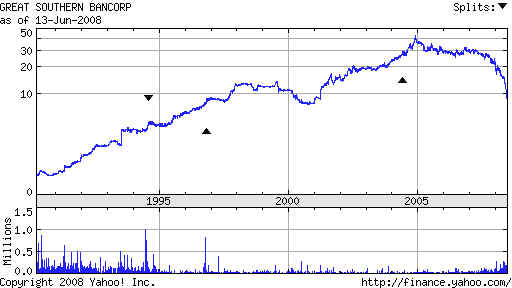

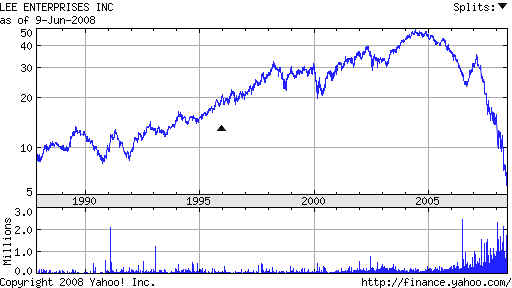

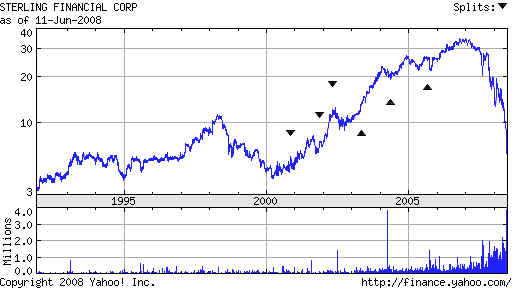

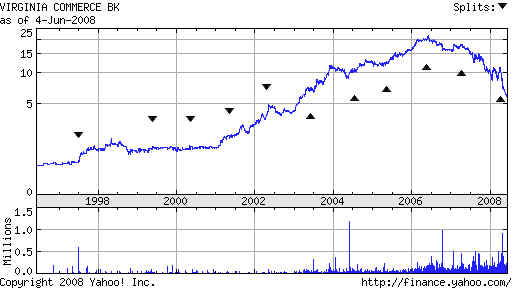

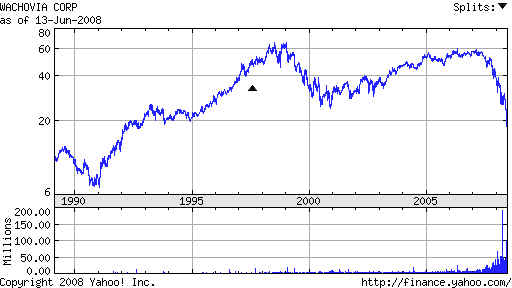

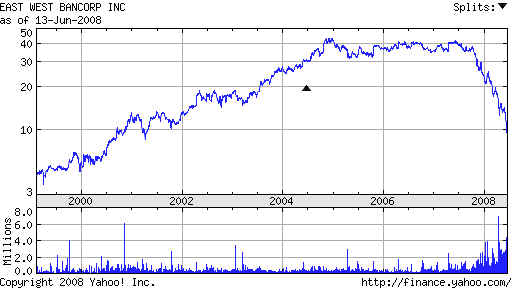

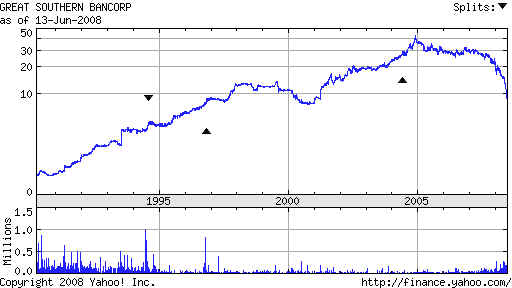

| Table 5 - New Lows/Bearish Stocks - over $5.00 Weak OBV and negative IP21 (>-.15) and New Lows ---- New Lows --- IP21must be blow -.10 ABCW 11.16 -.52 OBV confirming NL Anchor Bancorp Wisconsin BPFH 6.24 -.33 OBV confirming NL IP21=-.15 CATY 13.11 -.70 OBV confirming NL. high volume on deccline. CTBK 11.53 -.36 OBV confirms new low IP21= -.10 EWBC 9.51 =.23 OBV confirming NL. high volume on deccline. FTBK 11.44 -.15 OBV confirming NL GSBC 8.74 -.31 OBV cofirming. IP21= -.40 LEE 5.13 -.15 OBV confirming IP21= -.45 PBKS 7.02 -.44 OBV not confirming IP21=-.29 STSA 6.01 -.22 OBV did not confirm Friday's low IP21=-.46 UNH 30.74 -.27 OBV not confirming IP21=-.10 VCBI 5.25 -.13 OBV confirming IP21= -.45 WB 18.19 -1.12 OBV confirming IP21= -.20 Bearish BRKS 9.62 +.18 IP21= -.20 CACB 8.13 +.13 IP21= -.12 EWBC 9.51 =.23 OBV confirming NL. high volume on deccline. GSBC 8.74 -.31 OBV cofirming. IP21= -.40 LCAV 7.70 -.27 IP21= -.30 LEE 5.13 -.15 OBV confirming IP21= -.45 XING 5.23 +.19 OBV is confirming. IP21=-.30 |