TigerSoft's Elite Stock

Professional Report

6/20/2008 -

(C) 2008 Wm. Schmidt, Ph.D.

Look also at a new list, Table 3.

This shows stocks with significant Accumulation Index bulges at some time this past year.

These stocks will show a Buy B24 if they make a new high. Use Buy B6, B7, B8 and

B9s.

Buy on pullbacks to a 50-day and a 50-day ma.

Contents:

Bullish Selections

Bearish Selections

Table 1 - Highest AI/200 Stocks

Table 2 - New High Stocks -

Table 3 - Accumulation Index Bulges

and Buy B12 Stocks

Table 5 - New Lows/Bearish Stocks - over $5.00

| Abbreviations: price versus 50 day ma: A=Above B=Below AR = Above rising (Bullish) BF = Below Falling H = 12 month high L= 12 month low. Current Accum. Index = IP21 TISI = 21-day ma of IP21 SS = Sell Short BO = Breakout NC = non-confirmation. |

| Buys

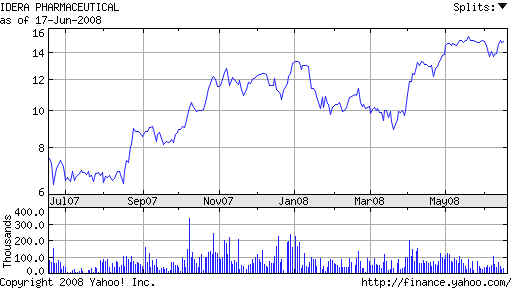

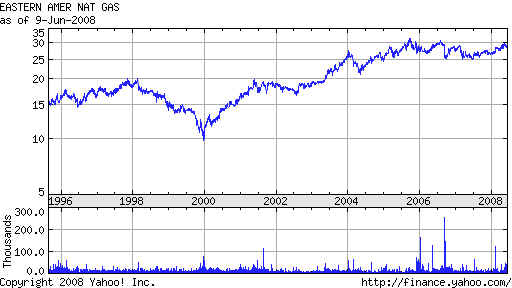

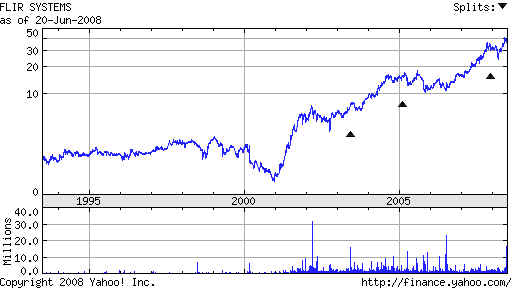

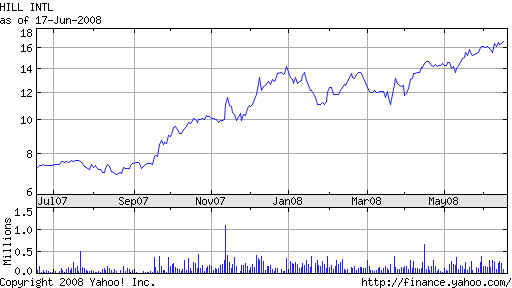

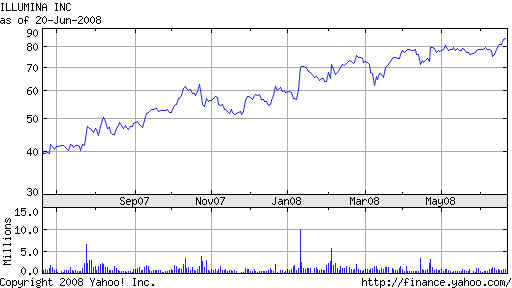

186 NGT 30 +.14 Challenging 30-31 high. OBV is making NH ahead of price. IP21=.20  127 FLIR 39.20 +.49 B12 OBV is making new highs ahead of price. 40.1 is 12 mo high. FLIR Systems, Inc. designs, manufactures, and markets thermal imaging and infrared camera systems in the United States and internationally. http://www.flir.com 1743 employees FLIR Systems Inc. 27700A SW Parkway Avenue Wilsonville, OR 97070  192 HIL 17.27 +.33 IP21=.15 Red high vol on NH Friday. Dot Hill Systems Hill International, Inc. provides fee-based project management and construction claims services primarily in the United States, Europe, the Middle East, North Africa, and the Asia Pacific. http://www.hillintl.com  160 ILMN 84.61 +.67 IP21=.15 Flat topped breakout at 82. Ilumina Illumina Inc. 9885 Towne Centre Drive San Diego, CA 92121 United States - Map Phone: 858-202-4500 Fax: 858-587-4297 Web Site: http://www.illumina.com Illumina, Inc. engages in the development, manufacture, and marketing of integrated systems for the analysis of genetic variation and biological function. It provides a line of products and services that serve the sequencing, genotyping, and gene expression markets.

|

|

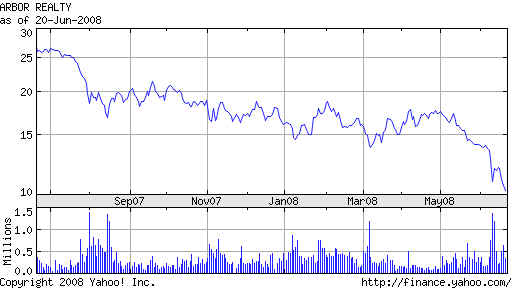

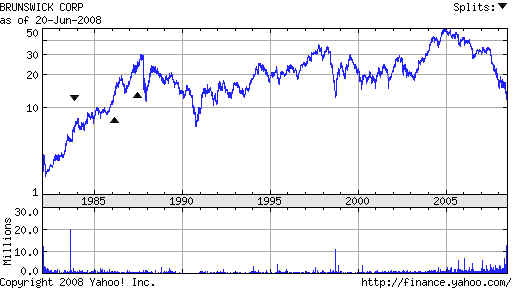

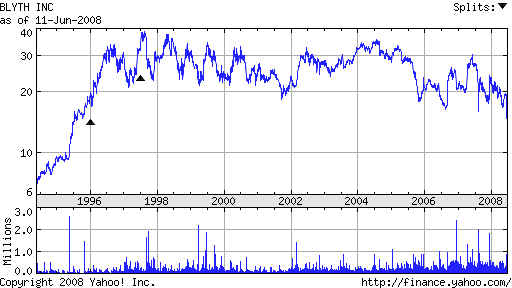

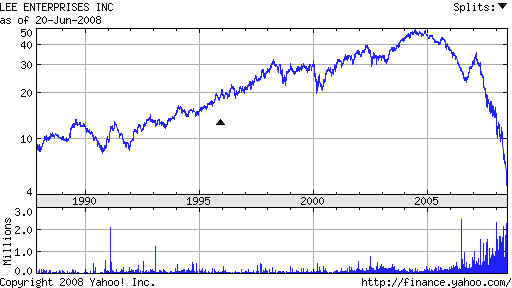

| Short Sales ABR 10.30 -.36 IP21=-.40 Serious breakdown Arbor Realty Trust, Inc. operates as a real estate investment trust (REIT).  83 AXS 31.22 -.57 IP21<-.25 and OBV confirming NL AXIS Capital Holdings Limited, through its subsidiaries, provides various insurance and reinsurance products to insureds and reinsureds.  54 BANR 9.59 -1.91 IP21<-.65 and OBV confirming NL Collapse occuring. Banner Corporation operates as the holding company primarily for Banner Bank that provides commercial banking services to individuals, businesses, and public sector entities in the United States.  40 BC 11.87 -.58 IP21<-.25 and OBV at NL Serious breakdown Brunswick Corporation engages in the manufacture and marketing of boats, marine engines, fitness equipment, and bowling and billiards equipment in the United States and internationally.  62 BSRR 16.98 -.40 IP21<-.35 and OBV at NL Serious breakdown. Sierra Bancorp operates as the holding company for Bank of the Sierra that offers retail and commercial banking services primarily in the central and southern sections of California's San Joaquin Valley.  31 BTH 13.68 -.57 IP21= -.25 OBV is at NL Very steady Distribution. Blyth, Inc., together with its subsidiaries, operates as a home expressions company. It operates in three segments: Direct Selling, Catalog and Internet, and Wholesale. The Direct Selling segment designs, manufactures or sources, markets, and distributes a line of products, including scented candles, candle-related accessories, fragranced bath gels, body lotions, and other fragranced products under the PartyLite brand name.  95 GCI 22.87 -.80 IP21=-.25 Gannett Publishing. Gannett Co., Inc. operates as a news and information company in the United States and the United Kingdom. It operates in two segments, Newspaper Publishing and Broadcasting.  24 LEE 4.69 -.07 IP21= -.40 Lee Enterprises, Incorporated publishes daily newspapers, weekly newspapers, and specialty publications in the United States. It provides local news, information, and advertising primarily in midsize markets, through 51 daily newspapers, as well as offers approximately 300 weekly newspapers and specialty publications in 23 states.  |

|

Table 1 - Highest AI/200 and Highest IP21 Stocks AR=Stocks must be above rising 50-day ma OBV should confirm IP21 must be over .05 Changes were for last week, unless otherwise stated. AI/200 Stock Notes ====== ================= ==================================================== 200 PLUS 13.40 +.09 Challenging high at 13.7 IP21=.25 Steady high acdcumulation. This is traded on the pink sheets. 200 CMKG 2.92 Thin...Very good OBV H=3.20 IP21=.50 Heavy accumulation. 199 CVF Castle Convertible 24.35 -.06 Red Sell H=26 IP21<0 194 BCF 18.06 -.17 OBV confirmed most recent NH IP21<0 December bulge of Accumulation. 192 SID 42.67 -2.17 IP21<0. below rising 50-dma Up from 18 a year ago. 196 HIX 9.82 IP21=.05 Possible turn around. Now slightly above rising 200-day ma | 192 SYT 64.58 -.53 IP21=.20 H=66 Very Good OBC Red Sell. 195 KTEC 36.58 -.02 IP21=.25 H=39.25 this week. OBV is lagging. 188 DAIO 5.56 -.18 H=6.7 IP21=.55 ITRS=.18 Red Sell Support at 21-day ma. 187 HCP 32.72 -.70 at rising 200-dma. below falling 50-dma H=38.25 OBV NC IP21=-.12 186 SNT 1.65 -.04 B12 1.95 is double top level. 186 NGT 30 +.14 Challenging 30 high. OBV is making NH ahead of price. IP21=.20 183 ISYS 40.32 +.24 NH IP21=.30 Last week B12 OBV NC 182 XBI 57.93 -1.03 H=62.4 IP21=.15 Red Sell OBV lagging 180 DBC 43.86 +.30 Running ITRS=.21 OBV is lagging. IP21<0. Feb Accum. Index bulge. Commodity ETFs - metals, oil, corn, wheat. 180 AKS 68.35 -2.78 IP21=.150 At flattening 50-dma. Flat resistance=73.25 AKS Steel ................................................................................................................. 179 TS 67.83 -.55 NH ITRS=.35 OBV lagging badly. IP21=.05 179 MOS 152.72 +1.47 NH this week at upper band. IP21=.15 OBV strong. 175 AXYS 58.26 -.27 Breakout point held on pullback. IP21=.27 Strong OBV 173 PMFG 47.00 -1.31 Challenging 48 high. IP21=.25

166 GSG 72.20 +.86 NH IP21<0 Sept &

April bulge of Accum. |

|

| Table 2

- New High Stocks - Stocks should be above 50-day ma. OBV confirm. IP21>.20 To Buy: IP21 should be over .24 or ITRS should be over .30 and AI/200 should be over 140 Consider a stock with an Accum. Index bulge over .50 to be capable of advancing for 12 months after the bulge. OBV confirms unless otherwise stated. 151 BAS 32.21 +.23 IP21=.15 178 CRT 53.44 +1.33 IP21=.25 OBV NC Cross Timbers Royalty 101 ELN 32.91 +.81 IP21=.45 Breakout was at 28. red high volume 167 FCL 83.35 +2.11 IP21=.12 Fuel Cell Technology ITRS=.45 192 HIL 17.27 +.33 IP21=.15 Red high vol on NH Friday. Dot Hill Systems 160 ILMN 84.61 +.67 IP21=.15 Flat topped breakout at 82. Ilumina IPI 67.66 +3.57 IP21=.20 New Issue. 143 SCL 44.15 +.34 IP21=.35 Breakout was at 43 Stepan Co. 122 SWSI 32.28 +1..43 28 was breakout. 127 WAR 48.57 +.39

|

|

| Table

4 - Buy B12s at or near New Highs 127 FLIR 39.20 +.49 |

|

| Table 5 - New Lows/Bearish Stocks - over $5.00 Weak OBV and negative IP21 (<-.15) and New Lows No recent positive bulges of Accum. ---- New Lows --- IP21must be blow -.10 and OBV confiring AI/200 ======= ABCW 10.54 -.51 OBV confirming NL Anchor Bancorp Wisconsin ABR 10.30 -.36 IP21=-.40 Serious breakdown 59 ARGN 9.11 -.28 OBV NC 83 AXS 31.22 -.57 IP21<-.25 and OBV confirming NL 54 BANR 9.59 -1.91 IP21<-.65 and OBV confirming NL Collapse occuring. 40 BC 11.87 -.58 IP21<-.25 and OBV at NL Serious breakdown 62 BSRR 16.98 -.40 IP21<-.35 and OBV at NL Serious breakdown. 31 BTH 13.68 -.57 IP21= -.25 OBV is at NL Very steady Distribution. 49 CTBK 9.62 -.39 IP21= -.35 OBV is at NL 28 DAVE 7.83 -.21 IP21=-.25 OBV is near 12 mo low. 95 DDS 13.10 -.65 OBV NC 58 EK 12.41 -.62 OBV NC 47 ETM 7.60 -.39 IP21=-.30 57 FRGB 6.40 -.53 IP21=-.25 66 FSNM 6.17 -.22 IP21=-.25 95 GCI 22.87 -.80 IP21=-.25 Gannett Publishing. 24 LEE 4.69 -.07 IP21= -.40 80 LORL 15.97 -.88 IP21= -.40 46 MBTF 6.81 +.08 80 OSK 34.68 +1.18 100 PAS 21.22 -.47 IP21=-.20 64 PBKS 6.26 -.22 IP21=-.28 Provident Bankshares 64 PFE 17.33 -.44 IP21=-.34 Pfeizer 65 PRWT 6.97 -.31 IP21=-.20 48 Q 3.90 -.19 IP21= -.25 62 RAI 49.41 -.42 IP21=-.30 39 RGR 6.95 -.18 IP21= -.35 97 SHLD 74.75 -2.50 IP21= -.30 74 SIL 5.06 -.36 IP21= -.35 100 SMG 20.37 - .71 IP21= -.30 59 TAYC 8.15 -.56 IP21= -.40 35 WGO 11.59 -1.23 IP21=-.20 84 WPO 559 -14.20 IP21= -.32 98 ZNH 21.50 -1.92 IP21=-.30 |