TigerSoft's Elite Stock

Professional Report

5/23/2008 -

(C) 2008 Wm. Schmidt, Ph.D.

Look also at a new list, Table 3.

This shows stocks with significant Accumulation Index bulges at some time this past year.

These stocks will show a Buy B24 if they make a new high. Use Buy B6, B7, B8 and

B9s.

Buy on pullbacks to a 50-day and a 50-day ma.

Contents:

Bullish Selections

Bearish Selections

Table 1 - Highest AI/200 Stocks

Table 2 - New High Stocks -

Table 3 - Accumulation Index Bulges

Table 4- Buy B12 Stocks

Table 5 - New Lows/Bearish Stocks - over $5.00

| Abbreviations: price versus 50 day ma: A=Above B=Below AR = Above rising (Bullish) BF = Below Falling H = 12 month high L= 12 month low. Current Accum. Index = IP21 TISI = 21-day ma of IP21 SS = Sell Short BO = Breakout NC = non-confirmation. |

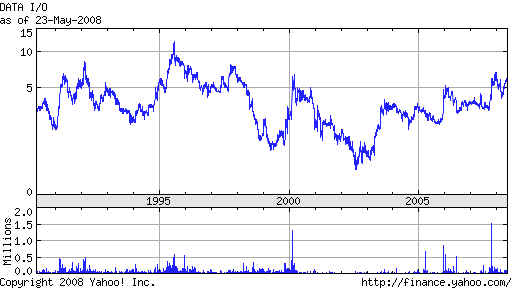

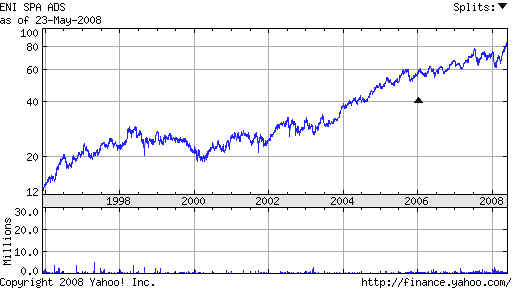

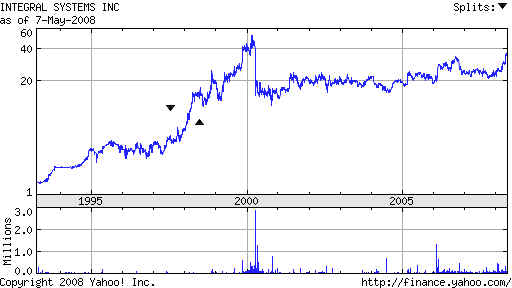

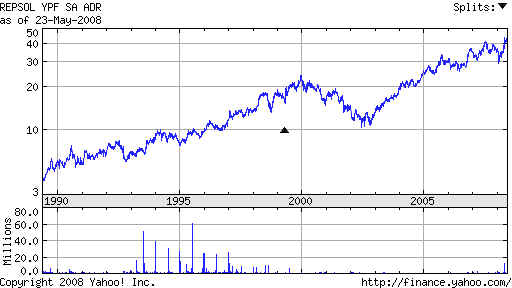

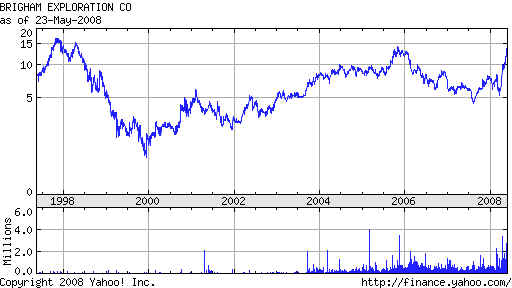

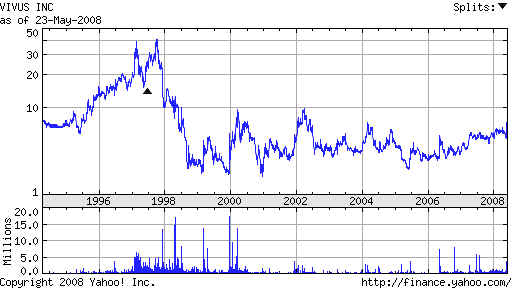

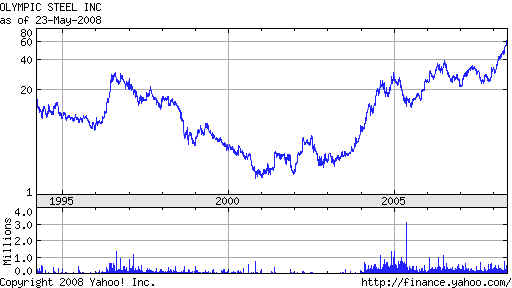

| Buys

185 DAIO 5.79 -.06 H=6.7 IP21=.50 ITRS-.28 Red Sell Support at 21-day ma.| Data I/O Corporation engages in the design, manufacture, and sale of programming systems used by designers and manufacturers of electronic products worldwide. The company offers a line of programming systems that include products, systems, modules, and accessories, which are used to program integrated circuits. 67 employees. Web Site: http://www.dataio.com Lots of overhead supply. So buy carefully at support.  159 E 83.42 -.72 IP21=.25 NH OBV is rising bullishly.  Eni SpA, an integrated energy company, operates in the oil and gas, electricity generation, petrochemicals, oilfield services, and engineering industries. Its Exploration & Production segment involves in the oil and natural gas exploration, field development, and production, as well as liquefied natural gas (LNG) operations in 36 countries, including Italy, the United Kingdom, Norway, Libya, Egypt, Angola, Nigeria, Congo, the United States, Kazakhstan, Russia, and Australia. Web Site: http://www.eni.it 172 ISYS 37.00 +.80 IP21=.35 NH strong OBV Jan bulge of Accum. Integral Systems, Inc. builds satellite ground systems and equipment for command and control, integration and test, data processing, and simulation. The company operates in four segments: 455 employees. Web Site: http://www.integ.com 52 seems a reasonable trading target.  155 POWL 51.92 -.27 IP21=.30 NH High volume B24 OBV NC Powell Industries, Inc. engages in the development, design, manufacture, and servicing of equipment and systems for the management and control of electrical energy and other critical processes worldwide. Web Site: http://www.powellind.com  170 REP 42.61 -.37 IP21=.25 H=46 Repsol YPF, S.A. operates as an integrated oil and gas company in Spain. It engages in the exploration, development, and production of crude oil and natural gas; transportation of petroleum products, liquid petroleum gas (LPG), and natural gas; petroleum refining; petrochemical production; and marketing of petroleum products, petroleum derivatives, petrochemicals, LPG, and natural gas. Web Site: http://www.repsol-ypf.com  151 BEXP Brigham Explor. 13.56 +.70 NH OBV confirming ... IP21=.12 Brigham Exploration Company engages in the exploration, development, and production of oil and natural gas in the United States. Web Site: http://www.bexp3d.com 14 seems a reasonable trading target, but the Accumil makes this look like it is headed for $20. Web Site: http://www.bexp3d.com  107 VVUS 7.20 +1.49 IP21=.05 Breakout was at 6.5 Three days of higher volume. VIVUS, Inc., a pharmaceutical company, engages in the development and commercialization of therapeutic products for underserved markets in the United States. 111 employees Web Site: http://www.vivus.com Expect lots of resistance at 10.  141 ZEUS 62.22 +2.85 IP21=.25 ITRS>.34 OBV at NH Olympic Steel, Inc. engages in the processing and distribution of processed carbon, coated and stainless flat-rolled sheet, and coil and plate steel products in the United States. 1,160 employees - Web Site: http://www.olysteel.com hqtrs in Ohio In strong steep group and running in all-time high territory,.  |

|

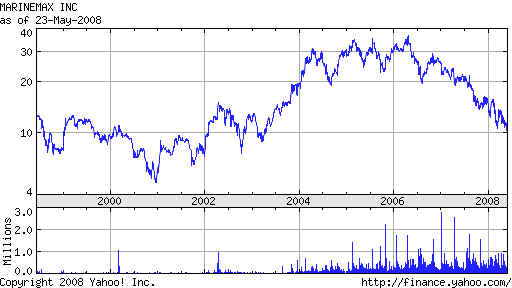

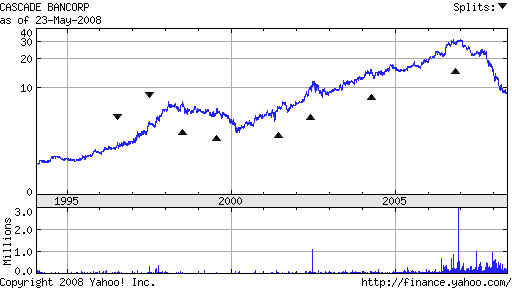

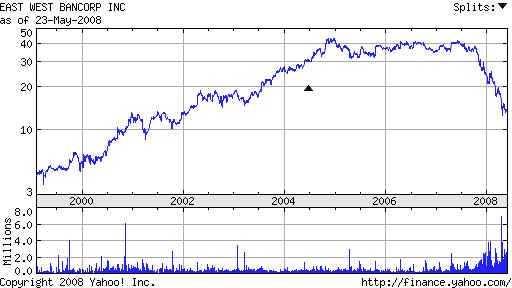

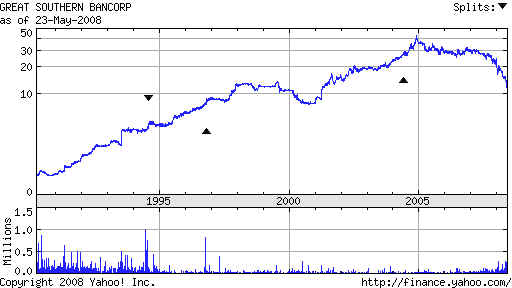

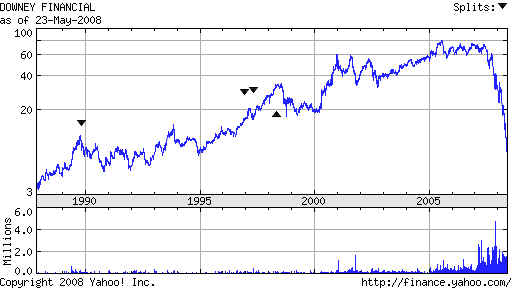

| Short Sales CACB AI/200=19 8.60 -.15 IP21<TISI Cascade Bank Cascade Bancorp operates as the holding company for Bank of the Cascades that provides commercial and retail banking services in Oregon and Idaho markets. Web Site: http://www.botc.com Bend, OR  EWBC AI/200=40 13.80 -.08 IP21=-.15 East West Bank East West Bancorp, Inc., together with its subsidiaries, operates as the holding company for East West Bank, which provides a range of personal and commercial banking services to small and medium-sized businesses, business executives, professionals, and other individuals in California. Web Site: http://www.eastwestbank.com  GSBC AI/200=36 11.79 -.15 IP21=-.10 Great So. Bank Great Southern Bancorp, Inc. operates as the bank holding company for Great Southern Bank, which offers financial services to customers primarily in southwest and central Missouri. Web Site: http://www.greatsouthernbank.com  DSL 8.29 -.55 IP21= -.18 Downey Financial Downey Financial Corp. operates as the holding company for Downey Savings and Loan Association, F.A. that provides various financial services to individual and corporate customers.  FTBK 14.36 -.32 IP21=-.30 Marginal new low. OBV NC Frontier Financial Corporation operates as the holding company for Frontier Bank that provides various commercial banking services. It primarily engages in generating deposits and originating loans.  HZO 10.31 -.45 IP21=-.05

Maginal new low. |

|

Table 1 - Highest AI/200 and Highest IP21 Stocks AR=Stocks must be above rising 50-day ma OBV should confirm IP21 must be over .05 AI/200 Stock Notes ====== ================= ==================================================== 200 CMKG 2.86 -.07 Thin...Very good OBV H=3.20 IP21=.60 Heavy accumulation. 200 CVF Castle Convertible 24.59 +.01 H=26 Breakout past declining long term ma at 23-23.5 IP21>.50 196 HIX 9.79 -.07 IP21=.20 Possible turn around. Now below falling 200-day ma 195 KTEC 35. -.92 IP21=.01 H=38.5 194 BCF 18.56 -.22 OBV confirmed NH IP21=.25 Red Sell. December bulge of Accumulation. 190 SID 49.48 -.43 NH OBV is OK ITRS>.27 and IP21>.15 189 PBR 72.38 +.36 IP21=.04 OBV confirming. 188 BBL 80.75 +-2.38 April spike of Accum. At earlier high. Watch Very good OBV, H=78 IP21=.10. 186 XBI 57.37 -.35 H=62.4 Red Buy. 186 UBB 142.23 OBV is lagging IP21=.2 184 ARA 86.05 -.19 NH ONB confirms. IP21=.05 Aracruz Celulose 186 IGE 151.28 -2.28 recent NH B24 IShares Goldman Natural Resources. Feb bulge of Accum. 185 DAIO 5.79 -.06 H=6.7 IP21=.50 ITRS-.28 Red Sell Support at 21-day ma. 183 DBC 41.82 +.08 Running ITRS=.04 OBV is confirming. Recent Accum. Index bulge. Commodity ETFs - metals, oil, corn, wheat. 181 HYV 11.71 at declining 200-day ma. IP21=.20 ................................................................................................................. 179 PLUS 11.50 -.42 Testing risaing 50-dma. IP21=.25 178 HCP 33.75 +.25 H=38.25 OBV NC IP21=-.05 183 HEIA 36.64 -.50 H=45 IP rising .35 ITRS=<0 Red Sell Very strong OBV 179 MOS 119.86 -2.65 H=141 IP21=.13 OBV strong. 178 ADRE Emerging Mkts ADR 55.85 -1.10 H=60.10 IP21=.25 OBV is strong 178

GSG 69.90 +.20 NH B24 Sept

& April bulge of Accum. Weakening OBV |

|

| Table 2

- New High Stocks - Stocks should be above 50-day ma. OBV confirm. IP21>.20 To Buy: IP21 should be over .24 or ITRS should be over .30 and AI/200 should be over 140 Consider a stock with an Accum. Index bulge over .50 to be capable of advancing for 12 months after the bulge. 80 BUD 56.61 +4.03 on Friday. ITRS and OBV NH, too. ATAI 17.08 +1.17 Breakout was at 13. B12. High volume. ATA, Inc computer-based testing services in the People's Republic of China. The company offers its services for the creation and delivery of computer-based tests based on its proprietary testing technologies and test delivery platform. Its computer-based testing services are used for professional licensure and certification tests in various industries, including information technology, services, banking, teaching, securities, insurance, and accounting. 328 employees 98 CRMT 16.17 +.59 Almost B12 - ITRS=.28 161 FDG 79.03 +3.03 IP21=.30 OBV at NH ITRS=.45 Note bulge of accum in January. Fording Canadian Coal Trust operates as an open-ended mutual fund trust in Canada. The company holds a 60% interest in Elk Valley Coal, which produces and sells metallurgical coal that is used for making coke by integrated steel mills. Web Site: http://www.fording.ca 122 NVB 20.26 +.07 IP21=.25 OBV at NH 153 TWTI 10.21 +.52 IP21=.25 ITRS=.10 107 VVUS 7.20 +1.49 IP21=.05 Breakout was at 6.5 Three days of higher volume. VIVUS, Inc., a pharmaceutical company, engages in the development and commercialization of therapeutic products for underserved markets in the United States. 111 employees Web Site: http://www.vivus.com 141 ZEUS 62.22 +2.85 IP21=.25 ITRS>.34 OBV at NH Olympic Steel, Inc. engages in the processing and distribution of processed carbon, coated and stainless flat-rolled sheet, and coil and plate steel products in the United States. 1,160 employees - Web Site: http://www.olysteel.com hqtrs in Ohio

|

|

Table 4- Buy B12 Stocks Less than 10% fromt their highs: GIII, LGVN, NLS ATAI 17.08 +1.17 Breakout was at 13. B12. High volume. ATA, Inc computer-based testing services in the People's Republic of China. The company offers its services for the creation and delivery of computer-based tests based on its proprietary testing technologies and test delivery platform. Its computer-based testing services are used for professional licensure and certification tests in various industries, including information technology, services, banking, teaching, securities, insurance, and accounting. 328 employees CTT 3.04 -.22 NH confirmed and B12 DRS Technology 78.47 -.15 GVN 1.35 -.13 VSCI 4.60 -.07 head and shoulders top |

|

| Table 5 - New Lows/Bearish Stocks - over $5.00 Weak OBV and negative IP21 (>-.15) and New Lows ---- New Lows --- IP21must be blow -.10 ABCW 14.02 -.72 Anchor Bancorp AAR 18.95 -.54 AAR Corp BAMM 7.50 -.47 Books-A Million IP21=-.05. BYD 15.53 -.81 Biyd Gaming Corporation IP21=-.14 CAL 13.18 -1.16 IP21=-.15 OBV confirming. CNB 6.38 -.24 Colonial BancGroup -.25 CRBC 5.74 -.26 IP21=-.40 DSL 8.29 -.55 IP21= -.18 Downey Financial FTBK 14.36 -.32 IP21=-.30 Marginal new low. OBV NC HZO 10.31 -.45 IP21=-.05 Maginal new low. LEE 6.69 -0.22 IP21=-.07 MBWM 8.75 -.02 IP21=-.30 PNCL 6.63 -.37 IP21=-.30 SBKC 5.50 -.27 IP21=-.40 SKYW 14.87 -.61 IP21=.13 VCBI 6.40 -.15 IP21=.30 CRFT 6.45 -.04 IP32=-.35 CTB 11.38 -.27 IP21=-.30 Cooper Tire and Rubber Steady Distribution: AI/200<20 ASFT AI/200=32 7.37 +.29 IP21=-.25 CACB AI/200=19 8.60 -.15 IP21<TISI Cascade Bank CIX AI/200=36 5.91 -.19 IP21=-.30 EWBC AI/200=40 13.80 -.08 IP21=-.15 East West Bank GSBC AI/200=36 11.79 -.15 IP21=-.10 Great So. Bank LEE AI/200=22 6.69 -.22 IP21= -.10 MNI AI/200=38 9.02 -.04 IP21=-.20 AI/200=38 NTGR AI/200=44 18.40 -.28 IP21=-.20 AI/200=44 XING AI/200=14 6.27 -.10 IP21=-.25 |